Home Ownership and Real Estate Investment in East Africa

A Comparative Analysis of Kenya, Uganda, Rwanda, and Tanzania

The East African region, comprising Kenya, Uganda, Rwanda, and Tanzania, is experiencing rapid urbanization, driving the demand for housing and real estate investment. Each country presents unique opportunities and challenges for homeowners and real estate investors. This article explores the state of house ownership, compares real estate investment landscapes, and provides statistics on homeownership and rental patterns in rural and urban areas across these four nations.

1. Kenya: A Growing Hub for Real Estate Investment

House Ownership and Renting Patterns

Kenya is the largest economy in East Africa, with a vibrant real estate sector, especially in urban centers like Nairobi, Mombasa, and Kisumu. The Kenyan government has made affordable housing a key pillar of its development agenda under the Big Four Plan. Despite these efforts, homeownership remains a challenge for many Kenyans.

- Urban Areas: In Nairobi, only about 15% of residents own homes, while the majority (around 85%) rent. The high cost of land and housing in urban areas has made homeownership difficult for middle and lower-income earners.

- Rural Areas: In contrast, rural areas have a higher homeownership rate, with about 60-70% of residents owning their homes. However, these homes are often informal structures lacking proper infrastructure.

Kenya’s real estate sector has attracted significant local and international investment. The country’s growing middle class, coupled with increased foreign direct investment, has led to a boom in the construction of residential, commercial, and industrial properties. Nairobi, in particular, has become a regional hub for real estate development.

2. Uganda: Steady Growth with Potential

House Ownership and Renting Patterns

Uganda’s real estate market is growing steadily, though at a slower pace compared to Kenya. Kampala, the capital city, is the focal point of real estate activity, driven by a growing middle class and urbanization.

- Urban Areas: Approximately 20% of Kampala’s residents own homes, while the remaining 80% are renters. The high cost of land and limited mortgage financing options are key barriers to homeownership.

- Rural Areas: In rural Uganda, homeownership is much more common, with about 75-80% of residents owning their homes. These are typically self-built houses with limited access to utilities and infrastructure.

Real Estate Investment

The real estate sector in Uganda is underdeveloped compared to Kenya, but it holds significant potential. The government’s efforts to improve infrastructure, coupled with an expanding middle class, are driving demand for housing. However, challenges such as land tenure issues and inadequate financing options hinder rapid growth.

3. Rwanda: Emerging Market with Focused Growth

House Ownership and Renting Patterns

Rwanda’s real estate market is emerging, characterized by government-led initiatives to improve urban housing. Kigali, the capital, is at the center of this growth, with the government playing a significant role in urban planning and housing development.

- Urban Areas: Kigali has a homeownership rate of about 30%, with 70% of the population renting. The Rwandan government’s focus on affordable housing is gradually increasing homeownership rates.

- Rural Areas: Rural homeownership in Rwanda is high, with approximately 80% of residents owning their homes. These homes are often built using traditional methods, and access to modern amenities remains limited.

Real Estate Investment

Rwanda’s real estate sector is characterized by a strong government influence, with numerous projects aimed at providing affordable housing. The country’s stable political environment and ease of doing business have attracted investors, though the market remains small compared to its neighbors.

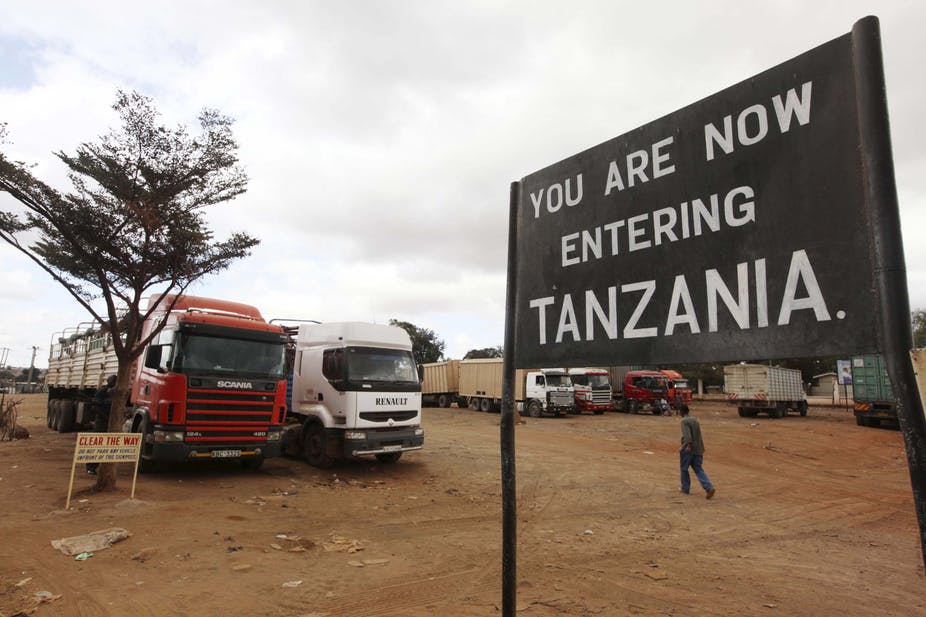

4. Tanzania: A Market with Untapped Potential

House Ownership and Renting Patterns

Tanzania has a large population and a rapidly urbanizing landscape, particularly in Dar es Salaam, the commercial capital. However, the real estate market is still in its early stages of development.

- Urban Areas: In Dar es Salaam, around 25% of residents own homes, while 75% rent. High land prices and limited access to credit are major barriers to homeownership.

- Rural Areas: Like its neighbors, Tanzania has a high rural homeownership rate, with about 70-75% of residents owning their homes. These homes are often traditional and lack access to modern infrastructure.

Real Estate Investment

Tanzania’s real estate sector is attracting growing interest, especially in tourism-related developments along the coast and in the capital. However, the market faces challenges such as complex land laws, inadequate infrastructure, and limited access to financing, which have slowed the pace of real estate development.

Comparative Analysis

- Homeownership Rates: Rwanda and Uganda have the highest rural homeownership rates, while Kenya and Tanzania have slightly lower rates. In urban areas, homeownership is generally lower across all countries, with Kenya having the most dynamic, yet challenging, urban housing market.

- Real Estate Investment: Kenya leads in real estate investment opportunities, followed by Tanzania, Uganda, and Rwanda. Each country presents unique opportunities, with Kenya and Tanzania offering more mature markets, while Uganda and Rwanda are emerging markets with untapped potential.

House ownership in East Africa is shaped by varying economic, social, and political factors across Kenya, Uganda, Rwanda, and Tanzania. While rural areas exhibit high homeownership rates due to traditional housing practices, urban areas face significant challenges, including high land costs, inadequate financing options, and rapid urbanization. For investors, Kenya and Tanzania offer the most developed real estate markets, while Uganda and Rwanda provide emerging opportunities with potential for growth. The real estate sector across these countries is poised for expansion, driven by growing demand for housing, urbanization, and infrastructure development.